Updated: October 15, 2024

What is the Stock Market?

The stock market is where individuals buy and sell shares of companies. In the Philippines, this trading occurs through the Philippine Stock Exchange (PSE).

Why Invest in the Stock Market?

Investing in stocks offers several advantages:

- High Returns: Historically, stocks have outperformed other investments like bonds or savings accounts.

- Ownership: Owning stocks means having a vested interest in the companies you invest in.

- Liquidity: Stocks are trade-able and can relatively be easily converted to cash compared to, say, real estate.

- Information Transparency: Listed companies update investors on material information (information that hasn’t been disclosed to the public but could affect investment decisions if known).

- Professional Management: The biggest Philippine companies are publicly traded and run by professionals.

How Investors Earn in the Stock Market

- Price Appreciation: When you sell a stock through a broker at a higher price than the price it was purchased.

- Dividends: A share of the company’s profits distributed to stockholders.

Frequently Asked Questions (FAQ)

- What kind of securities can be bought in the stock market?

- Common Stocks

- These represent ownership in a company and participation in its profits.

- Voting rights: Holders can vote on company decisions.

- Receive dividends based on their share of ownership.

- In case of corporate liquidation, common stockholders have the last claim on dividends.

- Preferred Stocks

- Offer benefits beyond common stocks.

- Receive dividends before common stockholders.

- Usually have a specified rate of return and redemption price.

- Warrants

- Issued by companies to raise additional capital.

- Holders have the right (but not the obligation) to subscribe to new shares at a set price within a specified time (detachable).

- Traded separately in the stock market.

- Philippine Deposit Receipts (PDRs)

- Grant rights related to underlying shares.

- Not certificates of ownership but provide certain rights.

- Common Stocks

- Why do companies have Initial Public Offerings (IPOs) (go public)?

- Capital Infusion

- Public listing allows companies to raise capital efficiently.

- Beyond traditional lenders, like banks, companies can tap into a broader investor base.

- This infusion of funds fuels expansion without increasing debt or depleting cash reserves.

- Visibility and Credibility

- Being listed brings more attention to the company.

- Public awareness increases, both locally and internationally.

- Customers take notice, and institutional investors can become interested.

- Capital Infusion

- Who is eligible to invest in stocks?

- Anyone 18 years of age and above that is able to deposit the minimum investment requirement specified by the broker.

- Where are funds deposited to when opening an account?

- The brokerage house’s bank account (Abacus Securities Corporation)

- The brokerage house’s bank account (Abacus Securities Corporation)

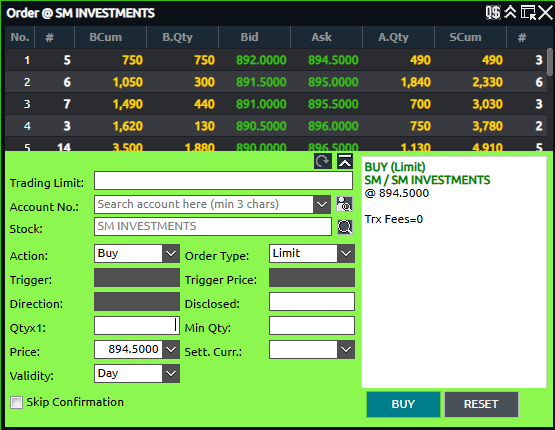

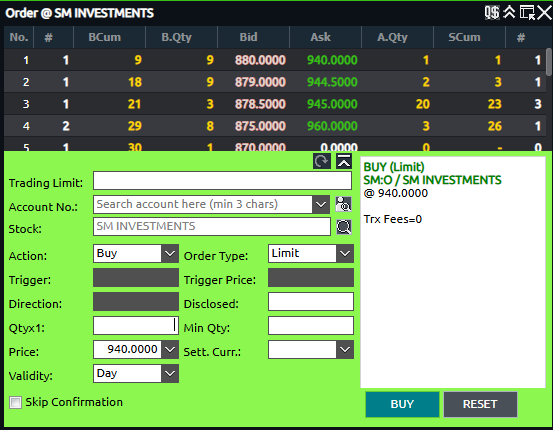

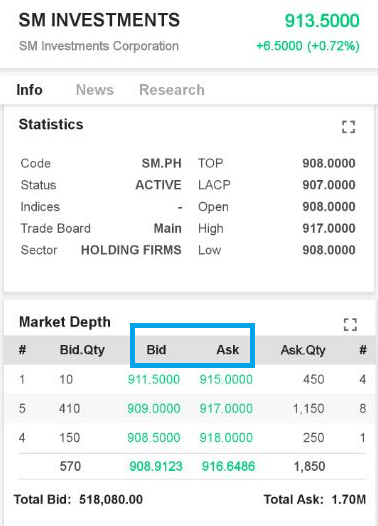

- What is the bid and ask?

- Bid: This is the highest price a buyer is willing to pay for a security.

- Ask: It’s the lowest price a seller is willing to accept for the same security.

- The difference between these two prices is called the spread.

- What is a Board Lot?

- A board lot represents the minimum number of shares an investor can buy or sell at a specific price range on the default Normal Board Lot market. The purpose is to minimize trading in “odd lots” (such as 12 shares) and facilitate easier trading.

| Price Range (PhP) | Tick Size | Lot Size |

| 0.0001 – 0.0099 | 0.0001 | 1,000,000 |

| 0.0500 – 0.2490 | 0.0010 | 10,000 |

| 0.2500 – 0.4950 | 0.0050 | 10,000 |

| 0.5000 – 4.9900 | 0.0100 | 1,000 |

| 5.000 – 9.9900 | 0.0100 | 100 |

| 10.0000 – 19.9800 | 0.0200 | 100 |

| 20.0000 – 49.9500 | 0.0500 | 100 |

| 50.0000 – 99.9500 | 0.0500 | 10 |

| 100.0000 – 199.9000 | 0.1000 | 10 |

| 200.0000 – 499.8000 | 0.2000 | 10 |

| 500.0000 – 999.5000 | 0.5000 | 10 |

| 1000.000 – 1999.000 | 1.0000 | 5 |

| 2000.000 – 4998.000 | 2.0000 | 5 |

| 5000.00+ | 5.0000 | 5 |