Updated: October 12, 2024

| Ticker | Annualized Dividend Yield (Gross) |

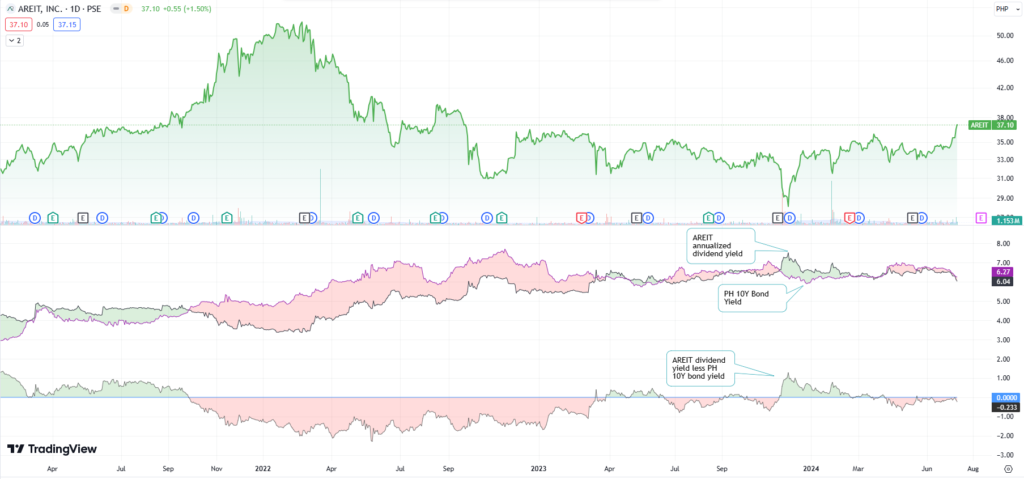

| AREIT | 6.04% |

| MREIT | 7.55% |

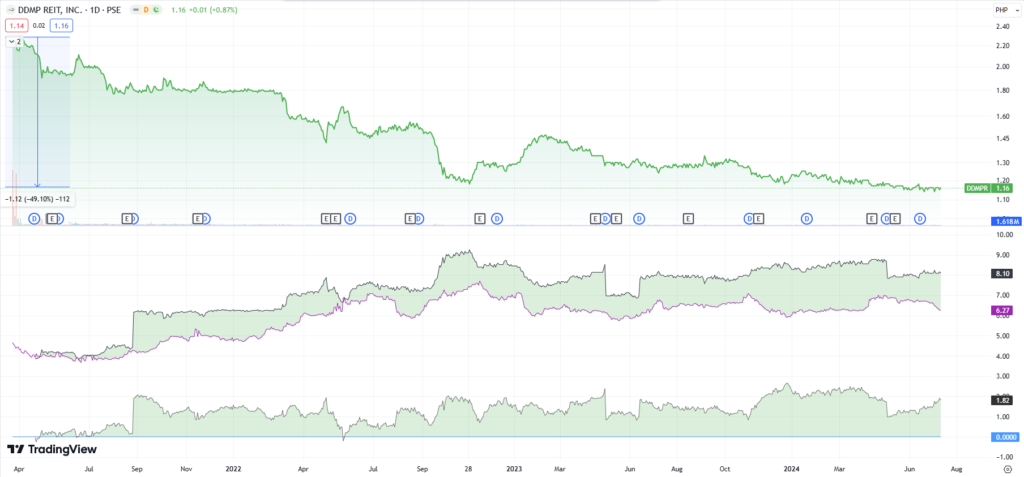

| DDMPR | 8.10% |

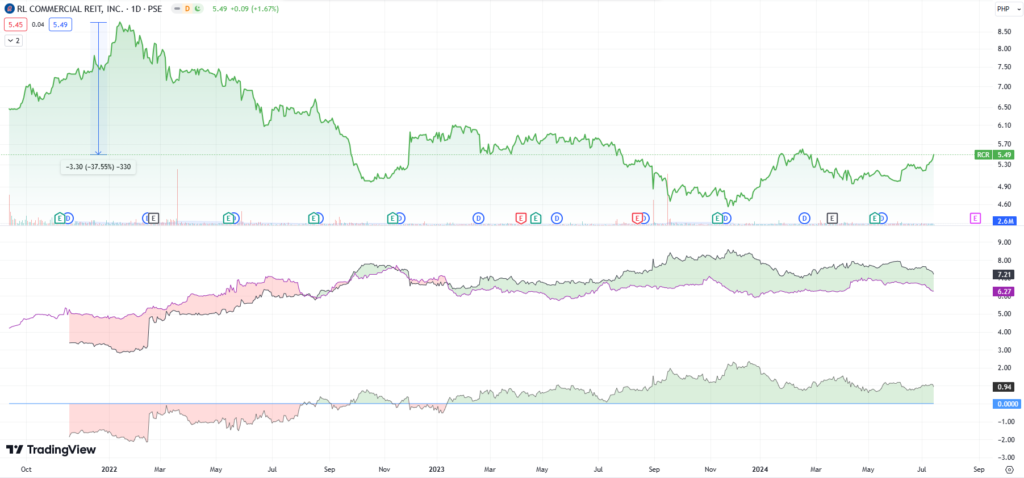

| RCR | 7.21% |

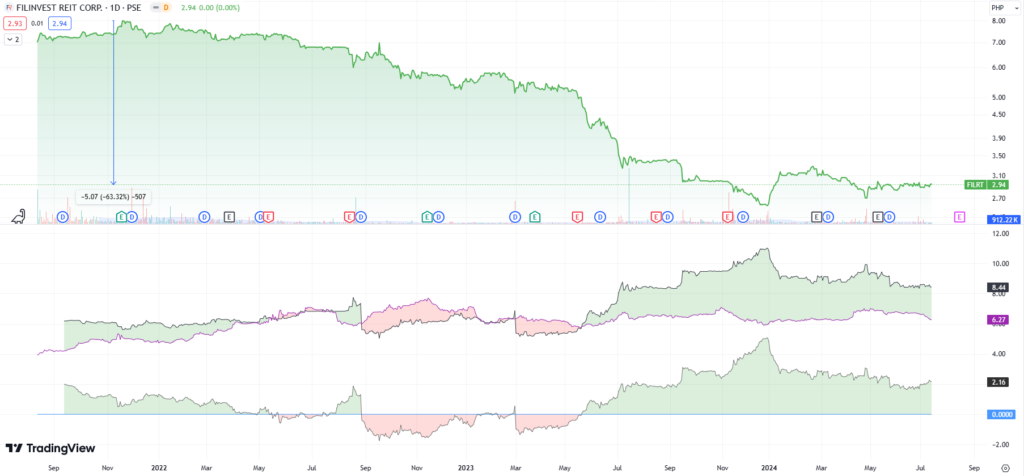

| FILRT | 8.44% |

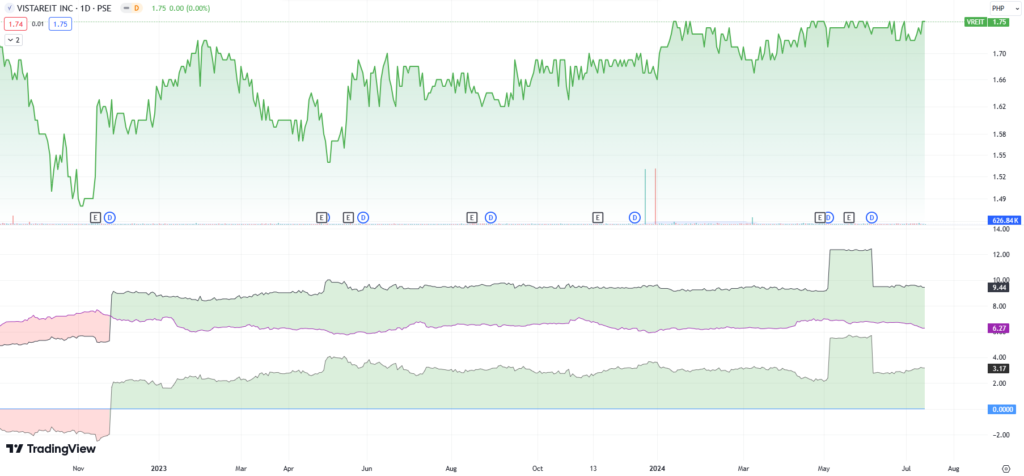

| VREIT | 9.44% |

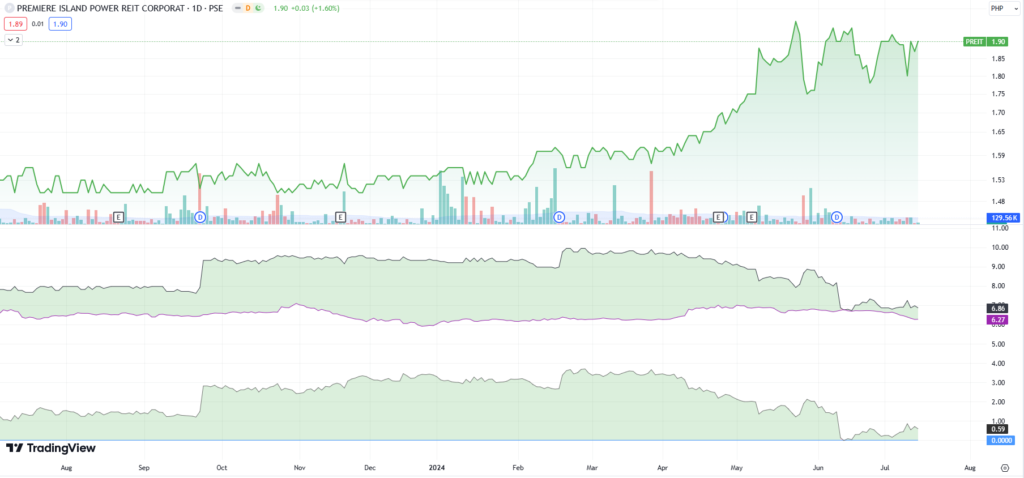

| PREIT | 6.86% |

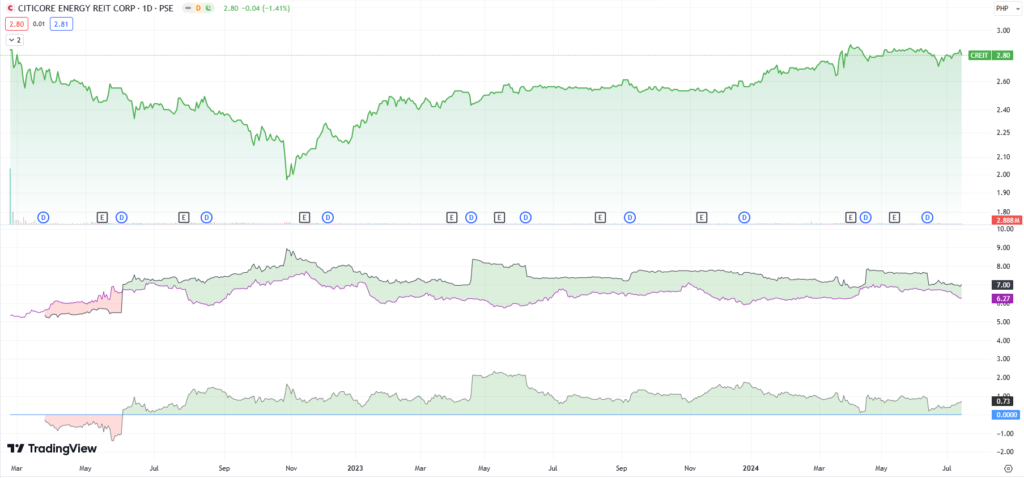

| CREIT | 7.00% |

(PSE: AREIT)

(PSE: MREIT)

(PSE: DDMPR)

(PSE: RCR)

(PSE: FILRT)

(PSE: VREIT)

(PSE: CREIT)

(PSE: PREIT)

Why REITs are Appealing for Income:

Regular Dividend Income: REITs must distribute at least 90% of their taxable income as dividends, ensuring a steady income stream.

Accessibility: Allows small investors to own shares in large properties with a relatively low minimum investment.

Liquidity: REIT shares are traded on the stock exchange, making it easy to buy and sell them.

Professional Management: Managed by experienced professionals, ensuring properties are well-maintained and income-generating.

Diversification: Investors can spread risk across different property types, reducing the impact of any single property’s performance.

REITs combine the benefits of real estate ownership with the convenience and liquidity of stock market investments, making them an attractive option for income-focused investors.

But there are more to REITs than dividend yields. You would want the ones that have a higher likelihood of making their dividend payments especially if you are partly relying on them for income. Send me a message to find out which ones we like.