Updated: October 12, 2024

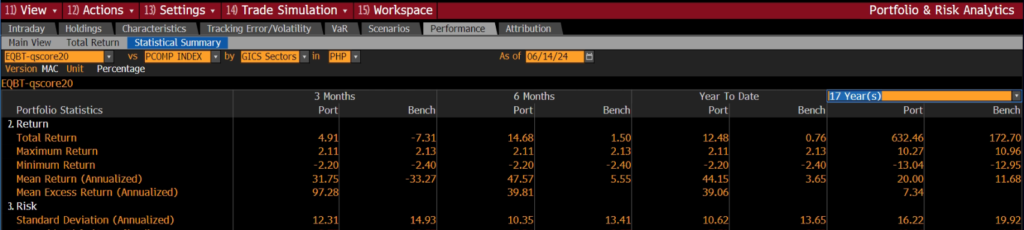

This is a backtest.

Click on images to enlarge.

For details, send me a message.

Terms

Mean Return (Annualized) – represents the average increase an investment experiences each year over a specific period. It shows how much your investment has grown on average each year, considering the effects of compounding. Imagine it as the “average speed” of your investment over time.

Standard Deviation (Annualized) – A measure of the volatility of the daily total returns over the stated timeframe, expressed as an annualized percentage. Imagine a surfer riding different-sized waves to their investment destination. When the waves are huge and rough, that suggests higher risk and a high standard deviation.

EMH vs. Factor Investing

Efficient Market Hypothesis (EMH): EMH posits that markets efficiently incorporate all available information into asset prices and hence the market cannot be beaten.

Factor Investing vs. EMH:

Factor investing questions the Efficient Market Hypothesis (EMH) by targeting specific factors that consistently affect returns. Factors such as value, momentum, low volatility, and profitability can potentially provide returns higher than the overall market.

Basis of outperformance from Key Factors

Value Factor

Value stocks (undervalued) tend to outperform growth stocks (overvalued) over time. Outperformance comes from buying cheap stocks and waiting for the market to recognize their true worth.

Momentum Factor

Momentum stocks (recent winners) tend to continue to perform well. Outperformance comes from riding trends and capitalizing on market psychology.

Low Volatility Factor

Low-volatility stocks (less volatile) often beat high-volatility stocks. Outperformance results from the market underestimating their stability.

Profitability Factor

Profitable companies tend to outperform less profitable ones. Outperformance comes from investing in well-run businesses.

Combining Factors for Consistent Returns

Diversification

Combining multiple factors tends to make the returns more consistent while reducing portfolio volatility.

The EQBT-qscore20 Model combines all factors mentioned above to pick 20 stocks from the most actively traded in the Philippine Stock Exchange but can contain less liquid names. To learn more send me a message.

Some companies below Php30Bln market capitalization are featured in the exclusive (for account holders) MyTrade Facebook Group:

https://web.facebook.com/groups/mytrademap

To learn more about the terms click here.